Business Insurance in and around El Paso

Looking for small business insurance coverage?

No funny business here

Your Search For Fantastic Small Business Insurance Ends Now.

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, extra liability coverage and worker's compensation for your employees.

Looking for small business insurance coverage?

No funny business here

Surprisingly Great Insurance

Your company is unique. It's where you earn a living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or a facility. Your business is your life's work. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a taxidermist. State Farm agent James Valenzuela is ready to help review coverages that fit your business needs. Whether you are a sporting goods store, an optician or a real estate agent, or your business is an acting school, an art store or a clothing store. Whatever your do, your State Farm agent can help because our agents are business owners too! James Valenzuela understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

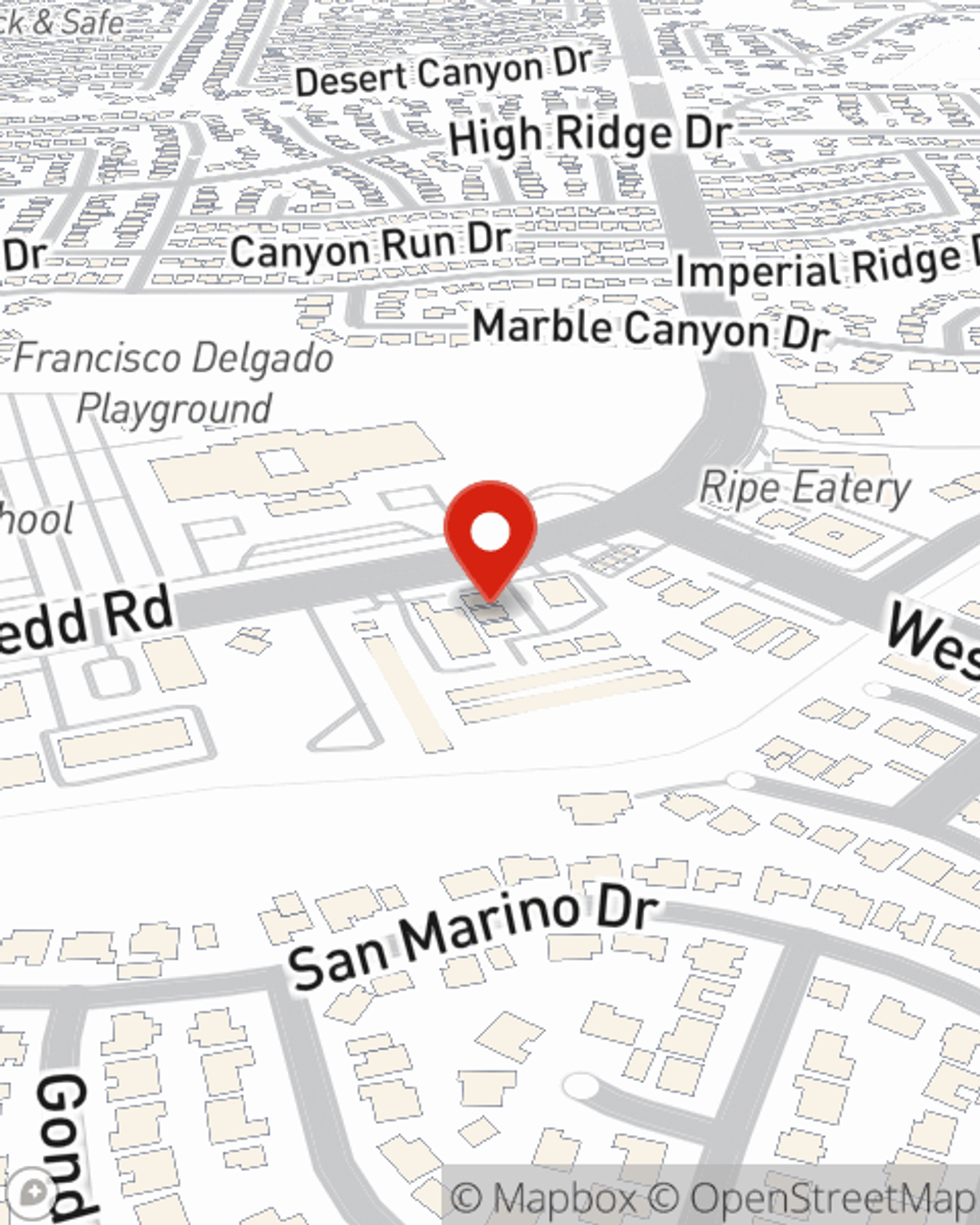

Ready to consider the business insurance options that may be right for you? Visit agent James Valenzuela's office to get started!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

James Valenzuela

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.